Sticky Supply

The industry is splitting into two classes of citizens: those under distress and those that will impress by riding out the downturn and coming out on the other side in a stronger position heading into the next cycle.

Gluts of everything from iron ore to copper are the main challenge for the industry. China’s slowest economic growth in a generation has led to oversupplies of metals, and for that, the industry is largely to blame, The big cost of environmental cleanups after closing a mine is preventing closures and prolonging the downturn.

“Excess supply is awash in most commodities and as painful as it is, economically and rationally it needs to leave the market to create a long term sustainable future.

Gold, this year’s best performing commodity, is giving miners some hope. Its safe-haven status makes it immune to many of the forces that have weighed on industrial metals and bulk commodities. The test is going to be now with this pick-up in the gold price and the absolute confusion around the global economy, and watching everyone suddenly rush back to gold and gold equities,” – said Mark Bristow, CEO of Randgold Resources

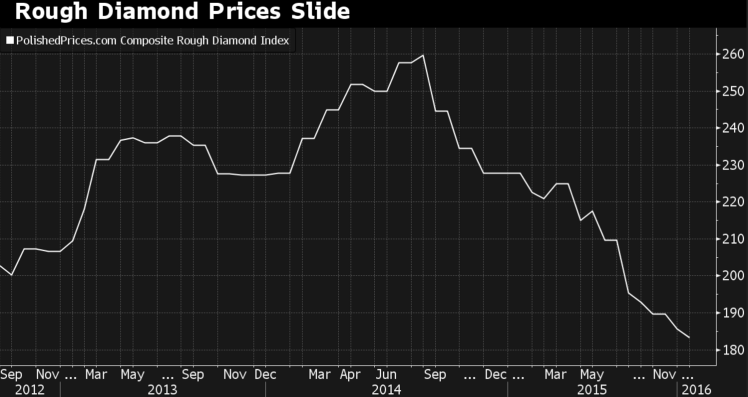

$1 Billion Diamond Sale May Be Too Much, Too Soon for Miners . .

It’s going to be very difficult to sustain the current exuberance of the market,the world’s two biggest diamond miners just sold $1 billion worth of gems and it’s making smaller rivals nervous.

January offerings by De Beers and Russia’s Alrosa PJSC, which control almost two-thirds of the market, far exceeded everyone’s expectations. The sales were driven by supply cuts last year that led to shortages, lower prices and better-than-expected holiday demand. But there are are concerns it’s too much too soon for an industry still reeling from the biggest rout in seven years. It could be an indicator that there is starting to be a little bit of appetite and that the decline has stopped,But it will need three or four months in a row to be able to say there’s a trend..! De Beers in December said polished diamond demand would fall 1 to 2 percent in 2015 compared with 3 percent growth a year earlier.

M.Magnolia ♦