The 2016 Democratic National Convention has confirmed Hillary Clinton as the party’s presidential candidate. This marks the first time a female has led a major party ticket, and now Clinton will try to become the first female to lead the nation when America votes for its 45th president this fall.. Hillary Clinton and Republican Presidential hopeful Donald Trump don’t agree on much, but one thing they both agree on is that the nation’s defensive capabilities need to be bolstered. It’s not clear exactly what that means, but broadly speaking, it bodes well for defense stocks.

Lockheed Martin Corporation (NYSE:LMT)

There’s nothing especially special about LMT It makes land and air vehicles for military and civilian use. It makes lots of components, too. Combined, it’s a nice, diversified product portfolio that mostly meets the military’s massive logistical needs that don’t necessarily make for splashy headlines. May be something of a Cinderella story under Clinton.

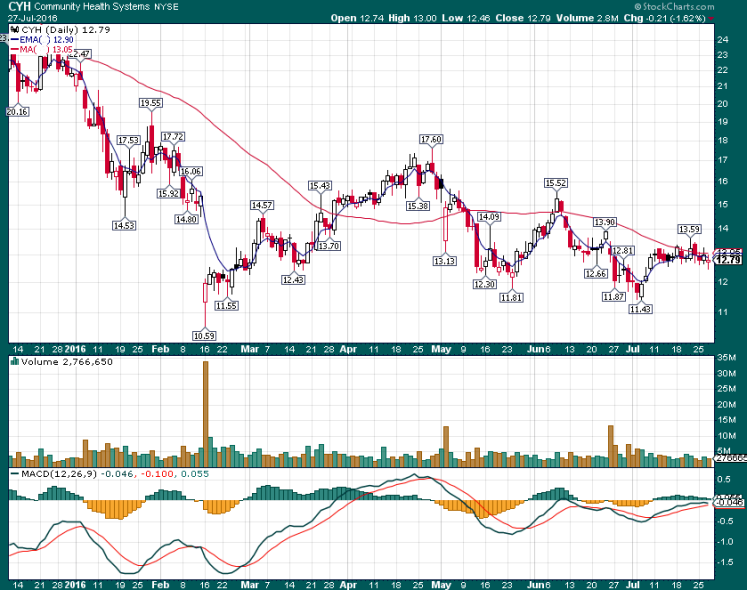

Community Health Systems (NYSE:CYH)

While Donald Trump and Hillary Clinton may agree that the nation’s defense needs to be beefed up, the two candidates couldn’t disagree more about the federal government’s role in individual citizens’ healthcare.The GOP candidate wants to repeal the Affordable Care Act — better known as Obamacare — and the Democratic nominee will likely seek to increase the number of insured individuals by putting even more legislation in place that includes lower deductibles and more generous tax benefits. More insured people means more revenue opportunity for hospitals, and one of the best-positioned beneficiaries is Community Health Systems. .

First Solar, Inc. (NASDAQ:FSLR)

President Barack Obama hasn’t been shy about trying to steer America further away from fossil fuels as a source for its energy needs, and toward greener, cleaner sources. Under his tenure, coal’s creation of electricity has fallen from 48% in 2008 to only 33% last year. Renewables, conversely, now create 7% of the country’s electricity, up from 2008’s 3.5%.

Hillary Clinton also is a fan of low-pollution solutions, perhaps even more so than Obama. And her very favorite may be solar power. Solar has not been an easy sector to remain excited about, granted. High-profile plays like SolarCity Corp (NASDAQ:SCTY) and Sunedison Inc (OTCMKTS:SUNEQ) have dished out nothing but misery for a couple of years now. But it’s not the premise of solar power that’s the problem — it’s the business model some solar companies employ. Solar panel manufacturers stand to do quite well under a Hillary Clinton presidency. She vowed to ensure the country will be using 500 million solar panels by the year 2020 — which would be seven times the number installed right now. That plays right into the hands of solar panel maker First Solar, Inc. (NASDAQ:FSLR).

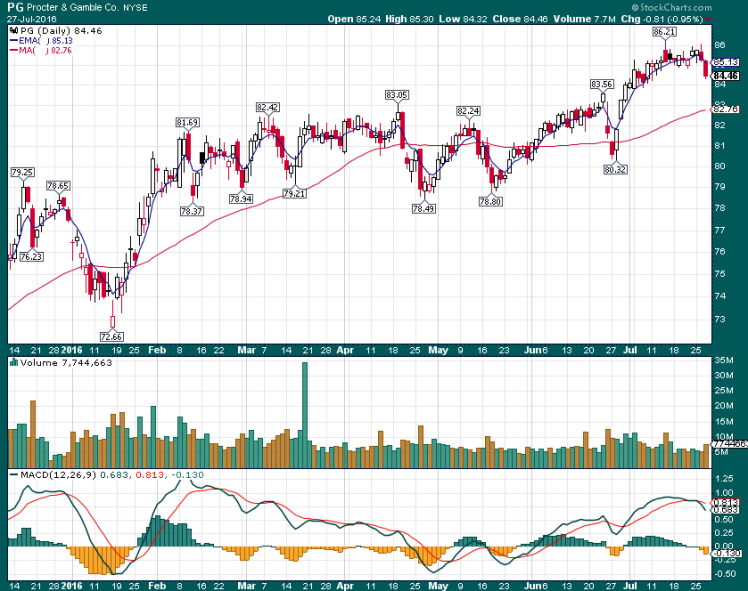

Procter & Gamble Co (NYSE:PG)

Some would say there’s never a bad time to step into a consumer staples name like Procter & Gamble Co (NYSE:PG); people pretty much always eat and bathe. But a big powerhouse consumer goods name like P&G may actually thrive under Clinton, and it has everything to do with the U.S. dollar. Hillary would be the candidate least likely to defend the dollar, which is now too strong for U.S. exporters to bear. She’s also the freest of the free trade candidates. Look at her behind-the-scenes work with her husband to open up NAFTA. There may be another big cross-border economic initiative waiting in the wings in a new Clinton administration. Right now some of our biggest exporters are the household products brands.. A strong dollar has been a lingering headache for Procter & Gamble; 60% of the company’s business is done overseas. In the first quarter of the year, revenue would have been 5% better had the dollar not been prohibitively pricey.

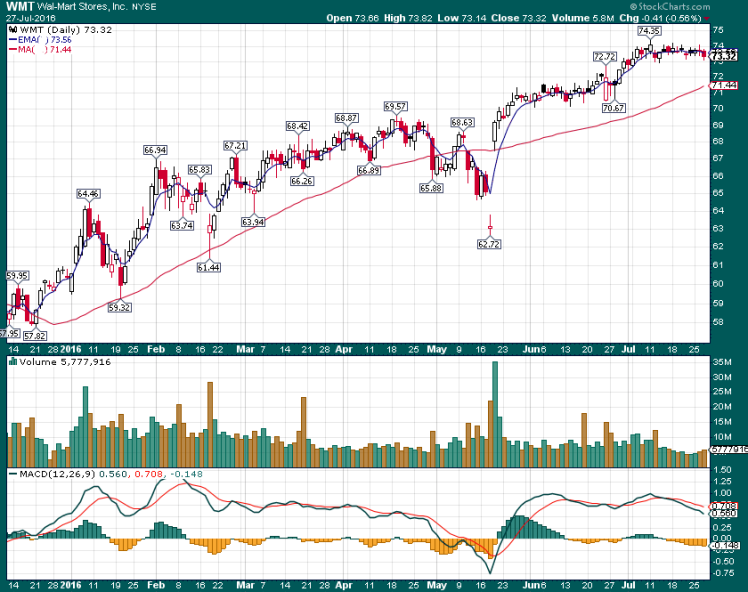

Wal-Mart Inc.(NYSE:WMT)

How could White House policy impact a value-oriented retailer like Wal-Mart Stores, Inc.(NYSE:WMT) ?

One of them is the prospect of rising wages. The grassroots movement to raise the country’s minimum wage is already underway, but that movement would accelerate inasmuch as Clinton aims for a national minimum wage of no less than $12 per hour. At that wage, 35 million American workers would get something on the order of a 40% to 50% raise, making it possible to make regular shopping trips to Walmart when they may not even be able to afford visits to the retailer now. Another big reason Walmart earns a spot on a list of stocks to buy if Hillary becomes President: She’s never met a global trade deal she didn’t like.

Both Clinton and newly named VP running mate Tim Kaine are now vocally supporting the controversial Trans-Pacific Partnership that would encourage even more free trade of goods and money across borders..

In a moment of writing J. Mason did not hold any of the above mentioned securities.

J. Mason ♦