The American equity benchmark topped its intraday record from May 2015, extending a rally sparked by jobs data that boosted optimism in the world’s largest economy. Emerging-market assets surged on bets U.S. rates remain low this year. Japanese shares advanced the most since February and the yen fell for the first time in a week after Prime Minister Shinzo Abe’s ruling coalition won a fresh mandate to unleash pro-growth policies. Nickel advanced with copper, while crude oil erased earlier losses.

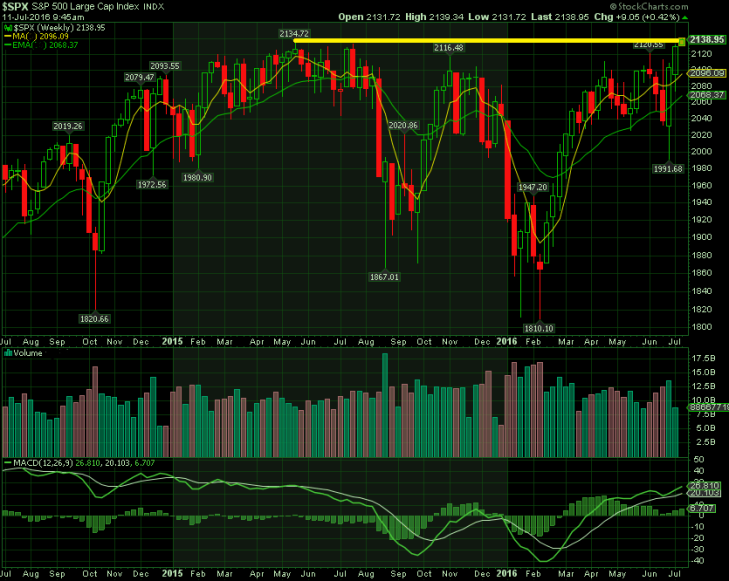

But let’s get back on the track with the U.S indices. . The S&P 500 were on pace to surpass a record closing high of 2,130.82, as Treasury yields held at record lows. The sharp swing higher for stocks was sparked by a June jobs report that showed that the U.S. created 287,000 new jobs in June, quelling some of the nagging fears that the labor market was beginning to sputter after the May report showed a measly 38,000 jobs (later cut to 11,000) were added.

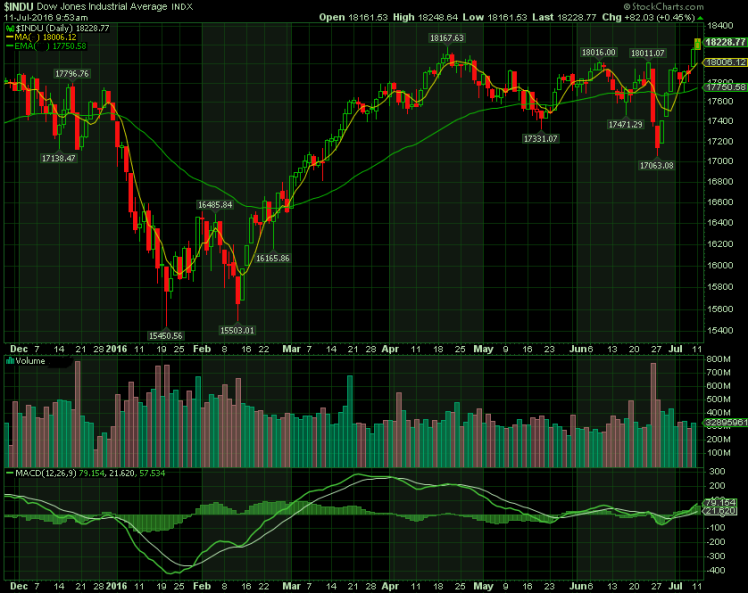

Those digits send the S&P 500 Index to an all-time high, while the dollar strengthened with industrial metals amid speculation the U.S. economy remains strong enough to propel global growth without forcing the Federal Reserve to tighten policy. Friday’s non-farm-payrolls report delivered a powerful jolt to investor confidence, which helped to erase all of the losses from the rout fueled by the U.K.’s decision to exit the European Union, dubbed Brexit, during a June 23 referendum. The Dow Jones Industrial Average DJIA, +0.47% and the Nasdaq Composite Index COMP, +0.62% and S&P 500 tanked in the wake of the vote.

Now, the Dow is just 166 points shy of its own all-time closing high of 18,312.39, reached May 19, 2015, and on it logged a fresh 52-week closing high on Friday. Meanwhile, the Nasdaq was enjoying the best daily jump of the three main stock-market benchmarks.

New heights for the S&P 500 should produce a collective cheer from investors, especially since equities quickly raced to new records after the gut-wrenching Brexit drop. However, the rally in stocks is making some uneasy because it’s happening as the yield on the benchmark 10-year note (TMUBMUSD10Y,) +2.53% closed at a record-low 1.366%, according to Dow Jones data.

What’s the matter ?

Well, investors typically don’t buy bonds and stocks at the same time.Bonds are considered a haven, while stocks are favored when risk appetite is higher. Bond prices move in the opposite direction of yields, so appetite for the perceived safety of bonds is driving yields lower even as investors scooped up equities at a rapid clip Friday. Global equities are almost back to where they were at the time of the U.K.’s June 23 vote to leave the European Union, which wiped almost $4 trillion off the value of the securities. Shares are getting support from the prospect of fresh fiscal and monetary stimulus in the U.K. to contain the fallout from the Brexit vote.

In other words, in a world rattled by the prospect of anemic global growth, both U.S. stocks and bonds are benefiting because they are the only game in town.

Even at the current low yields in the U.S., investors are still earning more than they could in the rest of the developed world. The U.S. Treasury’s also benefit from being the most liquid market—and get some buying for safe haven purposes.

J. Mason ♦